Search the Blog

Inside The Blog

Distinctive Properties

Important Links

Archives

-

Distinctive Properties

8022 W. Grandridge Blvd.

Kennewick, WA 99336Local: (509) 783-1431

Christmas is coming in just 11 days! We’re getting our first snow of the season (even though it’s too warm to stick, I think it still counts!) so it’s really beginning to look a lot like Christmas! We found some Christmas light shows that may be worth seeing in Pasco and Richland tomorrow, Dec. 15:

On Dec. 3, both Freddie Mac and Fannie Mae announced that they were going to cease evictions during the holidays so that families better enjoy the holidays. Fannie Mae said they would hold off on evicting foreclosed single family and 2-4 unit homes on December 19th, 2012 but resume again on January 2, 2013. Freddie Mac will stop evicting foreclosed homeowners on December 17th, 2012 and begin again on January 2, 2012.

For more details, please visit http://www.freddiemac.com/ or http://www.fanniemae.com/.

Merry Christmas!

Check out this neat little video on why it’s important to go with a Realtor rather than just a real estate agent. There is a difference!

According to the CBS Seattle news report from Dec. 4th, 2012, since 2011, carbon monoxide detectors are required in all new construction homes. Now in 2013, all residences will be required to have the alarms:, apartments, condos, townhouses, dormitories, etc. Single family homeowners will be required to furnish their home with a carbon monoxide alarm (if they have not already done so) before closing a sale on their home or if they obtain a remodeling permit.

The goal in requiring these detectors is to prevent a tragedy before it occurs—the requirement was developed after a winter storm in 2006 caused power outages in the Puget sound area, and hundreds of people were poisoned by carbon monoxide gas and eight died from carbon monoxide fumes according to the CBS Seattle News report.

Carbon monoxide is a colorless, odorless gas, which makes it hard to detect. According to the Centers for Disease Control and Prevention (CDC), carbon monoxide can accompany combustion fumes which are produced by ordinary household appliances such as heating systems, stoves, and ranges. Some of the symptoms of carbon monoxide poisoning are “headache, dizziness, weakness, nausea, vomiting, chest pain, and confusion,” according to the CDC. It can also cause death—which makes it extremely important to furnish your home with a carbon monoxide detector to protect you, your family and friends.

Please visit the CDC’s website for more information on how to protect your home from carbon monoxide, how to prevent your home appliances from emitting carbon monoxide fumes, and how to heat your home should you experience a power outage.

Source: CDC CO FAQs, http://www.cdc.gov/co/faqs.htm. Accessed 12/7/2012

Source: CBS Seattle “New Washington Carbon Monoxide Alarm Requirement in 2013.” Dec. 4, 2012.

According to a study conducted with 618 consumers in September by the Carlisle & Gallagher Consulting Group, one in three consumers would consider getting a mortgage loan from Wal-Mart, a discount retailer, and close to half would consider getting one from PayPal, an online payment provider.

While banks are not currently competing with these two companies for mortgages, since these companies do not currently offer mortgage lending services, the market has shown non-bank mortgage companies gaining market share while some banks have lost some market share from the financial crisis.

The study further revealed that 80% of consumers would consider getting a mortgage loan from a non-bank lender, but 70% would still prefer to get a mortgage through one of their main banks, however, only 39% currently do have mortgages through one of their main banks. Perhaps the reasons why consumers might be more motivated to buy a mortgage through Wal-Mart or PayPal stem from the main negative experiences with the mortgage application process (according to the survey): the high cost of getting the loan, the slow execution process, and the poor communication between lender and the applicant. Furthermore, according to Doug Hautop, lending practice lead at the Carlisle & Gallagher Consulting Group, consumers tended to focus on three main qualities they valued in mortgage lenders when choosing a mortgage: price, customer service, and trust.

Would you consider getting a mortgage from Wal-Mart or PayPal?

Source: “33% say they would buy a mortgage from Wal-Mart,” Reuters (Dec. 3, 2012) NBC News.com Business

Yesterday we got an email from the Washington State Deputy Communications Director, Dan Sytman, with a newsletter concerning an HVAC company in Washington State. The Washington State General Attorney’s office had received numerous complaints about the company’s business practices described under Washington State’s Consumer Protection Act as “unfair and deceptive.” The Washington State Office of the Attorney General is going after the company for their actions, and also advises anyone looking for the services of an HVAC company to take care in choosing the right company with which to do business.

Sarah Shifley, Assistant Attorney General, says, “Shop around instead of going with the first company you find. Demand estimates in writing and don’t let work begin until you are crystal clear about how much it will cost. Don’t assume that companies that price by the job instead of by the hour are always less expensive. Also, ask if any parts that need to be replaced are under warranty. If not, you can require the old parts be left with you.”

Shifley continues with suggestions about air duct cleaning, saying “You should also be skeptical about health-related claims about air duct cleaning, whether it’s done by an HVAC company or one that specializes in air duct cleaning. Don’t hire duct cleaners who make sweeping claims about the health benefits of their services or recommend duct cleaning as a routine part of your heating and cooling system maintenance. Finally, check out references and reviews, and consider getting a second opinion before hiring anybody.”

This advice from our Attorney General’s office is also good to keep in mind for anyone in any business. Businesses who take part in unfair and deceptive business practices often target the elderly, so be sure to pass on these suggestions to them as well!

According to the Tri-City Herald today, the Tri-Cities is rated 6th in nation for its growth in the “Metro Magnets Index,” which is a collection of data from 384 metro areas in the US provided by Pitney Bowes Software. However, they are also predicting that this growth will slow in the near future.

A growing community that is recognized nationally is more likely to attract investors because there is a greater potential for their investments to grow and yield greater returns. This in turn provides the Tri-Cities with a better, stronger community. Furthermore, this information means that the demand for housing in the Tri-Cities is increasing.

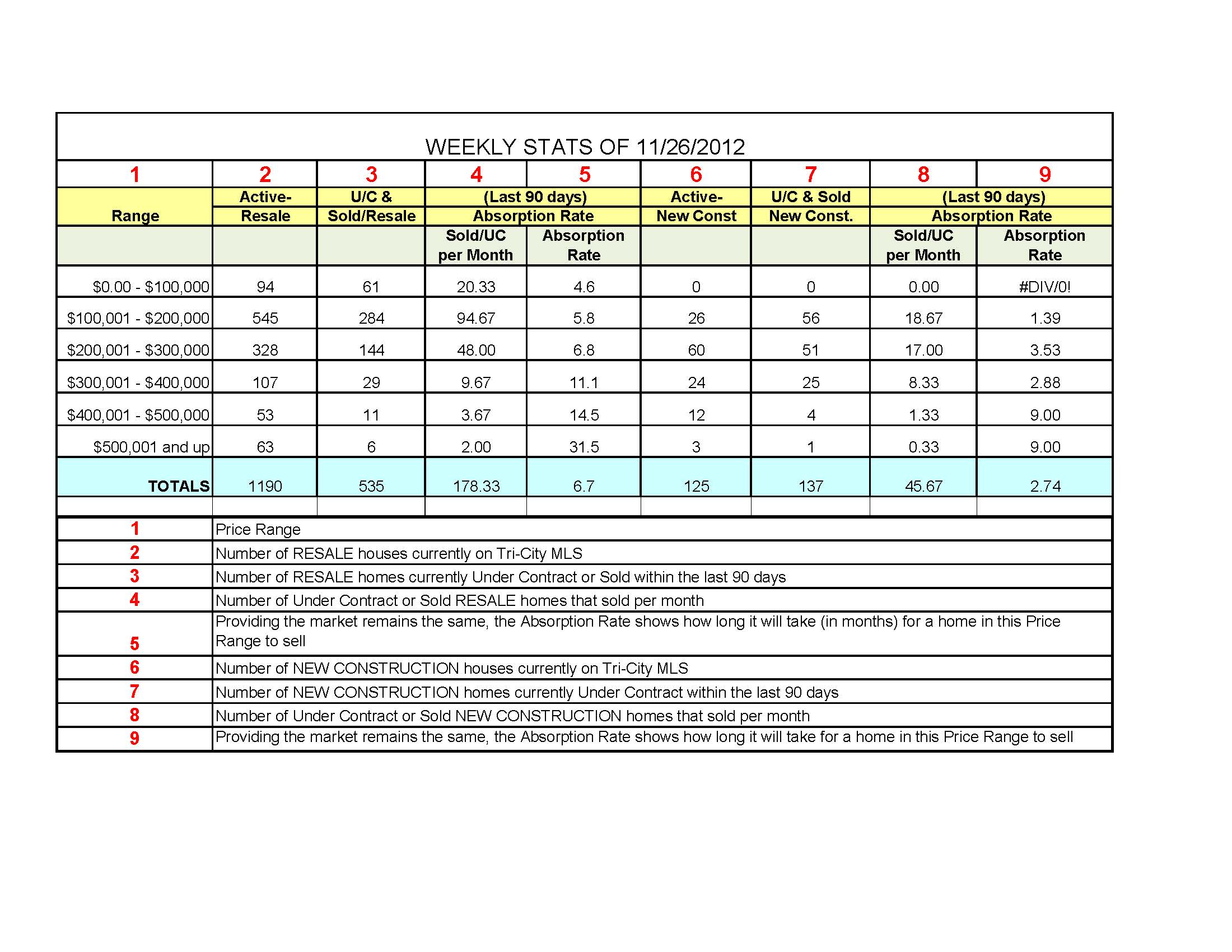

According to the current Tri-Cities market data we have analyzed in our “Monday Statistics,” the turnover rate for new construction is much, much higher than that of the resale properties. It suggests that buyers currently prefer new construction to previously lived-in homes.

According to the current Tri-Cities market data we have analyzed in our “Monday Statistics,” the turnover rate for new construction is much, much higher than that of the resale properties. It suggests that buyers currently prefer new construction to previously lived-in homes.

Our local expertise and Leading Real Estate Companies of the World. Is a winning combination, for YOU.

http://d3az96z2dvaaos.cloudfront.net/media/leadingre/website/WebsiteVideoFINAL_NewForWeb.mp4